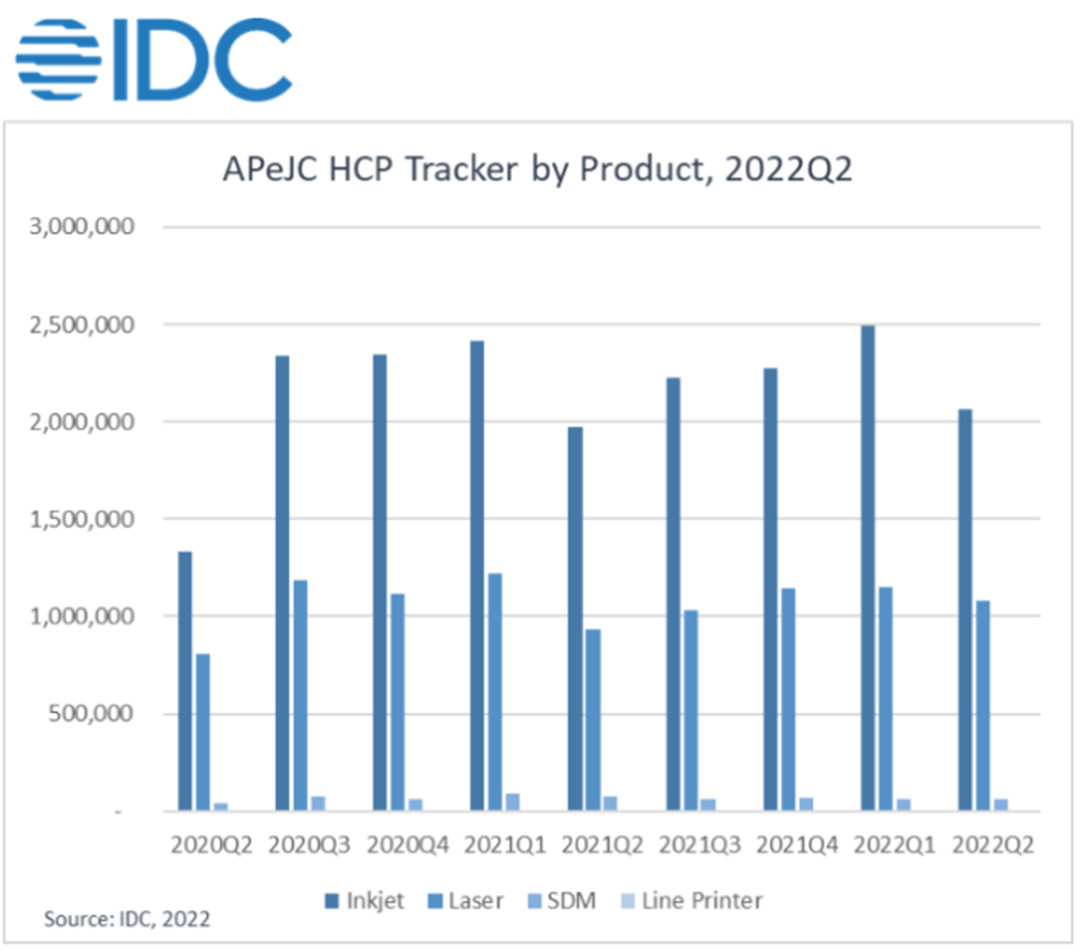

Regeneration RTM WORLD report /Printer shipments in Asia Pacific (excluding Japan and China) were 3.21 million units in the second quarter of 2022, up 7.6 percent year-over-year and the first growth quarter in the region after three consecutive quarters of year-over-year declines.

The quarter saw growth in both inkjet and laser. In the inkjet segment, growth was achieved in both the cartridge category and the ink bin category. However, the inkjet market saw a year-over-year decline due to a slowdown in overall demand from the consumer segment. On the laser side, A4 monochrome models saw the highest year-over-year growth of 20.8%. Thanks largely to a better supply recovery, suppliers took advantage of the opportunity to participate in government and corporate tenders. From the first quarter, lasers declined less than inkjet as demand for printing in the commercial sector remained relatively high

The largest inkjet market in the region is India. Demand in the home segment declined as the summer holidays began. Small and medium-sized businesses saw similar demand trends in the second quarter as in the first. In addition to India, Indonesia and South Korea also saw growth in inkjet printer shipments.

Vietnam's laser printer market size was second only to India and South Korea, with the largest year-over-year growth. South Korea achieved sequential and sequential growth as supply improved after several consecutive quarters of decline.

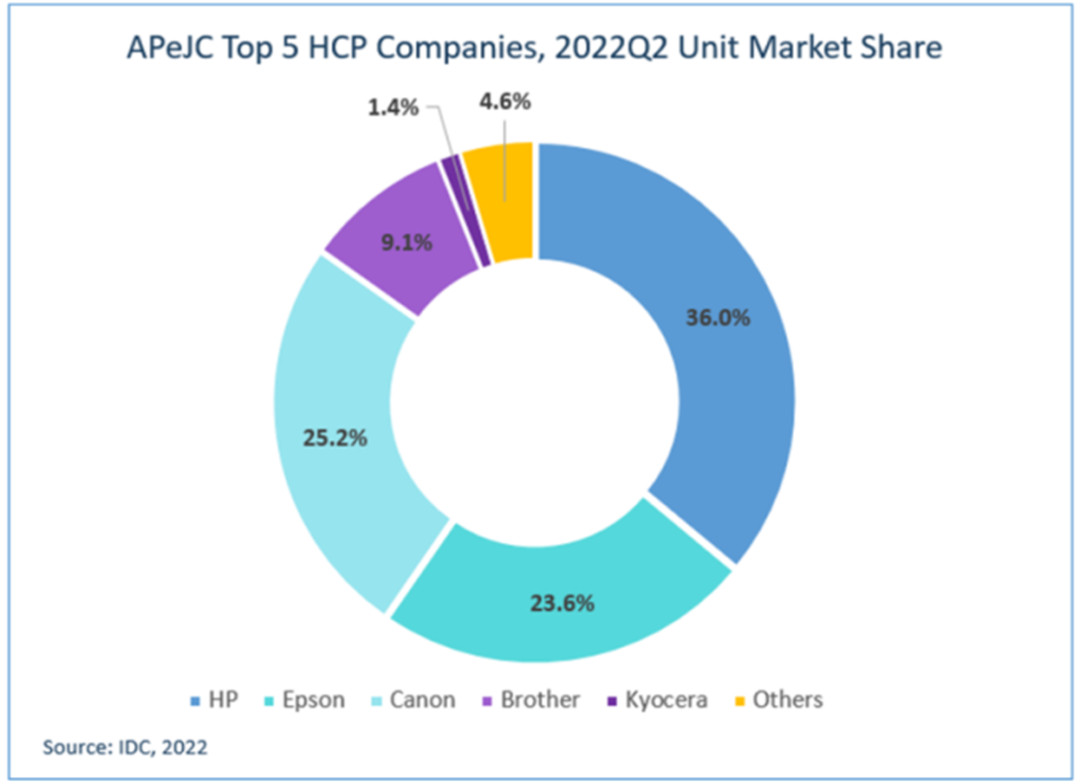

In terms of brands, HP maintained its position as the market leader with 36% market share. During the quarter, HP managed to overtake Canon to become the largest home/office printer supplier in Singapore. HP recorded a high year-over-year growth of 20.1%, but declined by 9.6% sequentially. HP's inkjet business grew 21.7% year-over-year and the laser segment grew 18.3% year-over-year because of a recovery in supply and production. Because of slowing demand in the home user segment, HP's inkjet shipments declined by

Canon ranked second with a total market share of 25.2%. Canon also recorded high year-over-year growth of 19.0%, but declined 14.6% quarter-over-quarter. Canon faced a similar market trend to HP, with its inkjet products declining 19.6% sequentially due to shifting consumer demand. Unlike inkjet, Canon's laser business experienced only a slight decline of 1%. Despite supply constraints for a few copier and printer models, the overall supply situation is gradually improving.

Epson had the third largest market share at 23.6%. Epson was the best performing brand in Indonesia, the Philippines and Taiwan. Compared with Canon and HP, Epson was severely affected by supply chain and production in many countries in the region. Epson's shipments for the quarter were the lowest since 2021, recording a 16.5 percent year-over-year decline and a 22.5 percent sequential decline.

Post time: Sep-07-2022